Bilateral Exchange Rate Investopedia

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

Fixed rate to fixed rate.

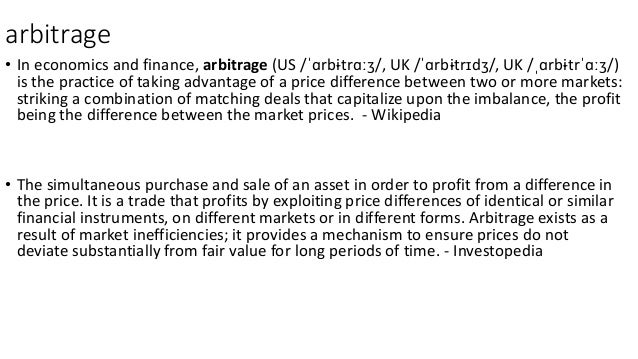

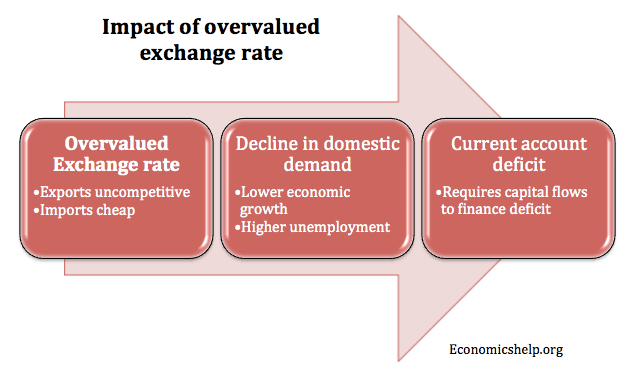

Bilateral exchange rate investopedia. Movements in rates among the big three currencies the dollar the euro and the yen can create difficulties for other countries particularly those that peg to one of those currencies. As with interest rate swaps the parties will actually net the payments against each other at the then prevailing exchange rate. The bilateral exchange is the common way of quoting a currency in that it involves two currencies in a pair. A trade agreement between two countries to reduce or eliminate trade barriers in a certain strategic category of goods.

An exchange rate is the price of a nation s currency in terms of another currency. For example the appreciation of the dollar. Floating rate to floating rate. The majority of the time the central or federal bank will be one side of the relationship and they are displayed using their three letter.

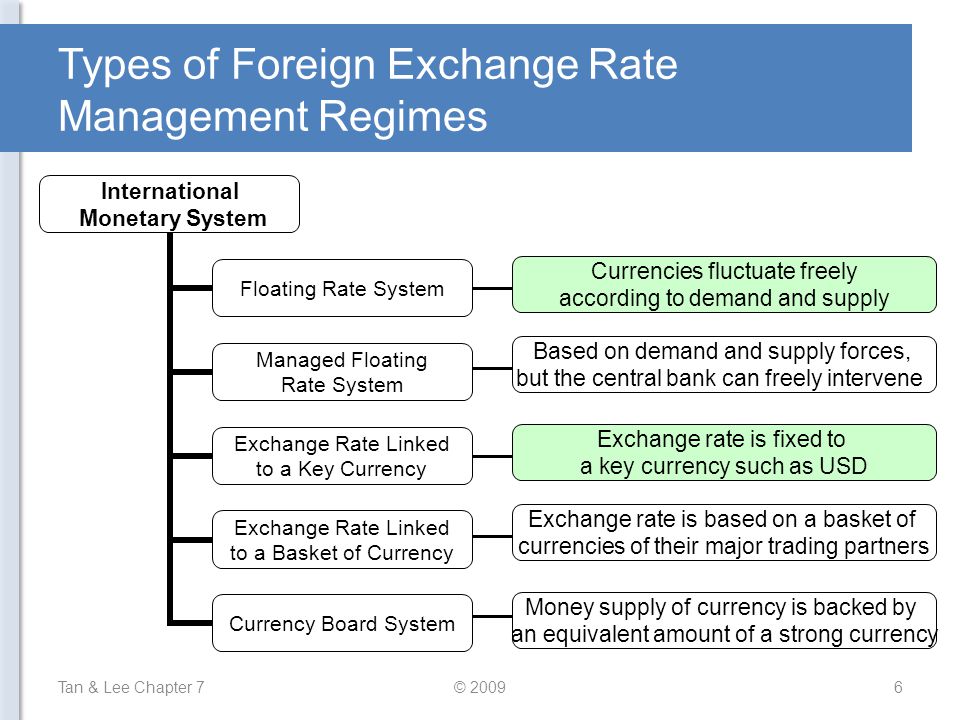

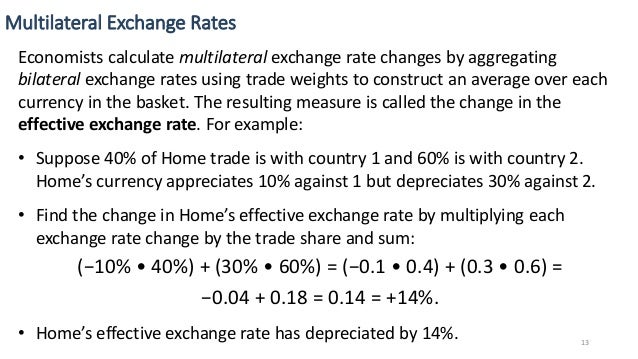

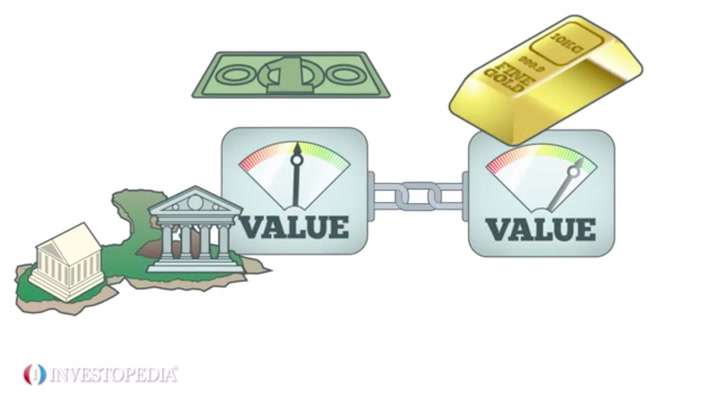

Bilateral exchange rate involves a currency pair while an effective exchange rate is a weighted average of a basket of foreign currencies and it can be viewed as an overall measure of the country s external competitiveness. Big three exchange rates. There are three variations on the exchange of interest rates. Exchange of interest rates in currency swaps.

A nominal effective exchange rate neer is weighted with the inverse of the asymptotic trade weights. If at the one year mark the exchange rate is 1 40 per euro then. The instability of exchange rates among the major currencies is a perennial concern. In the cleared world as many as four additional counterparties are potentially being inserted between the two transacting parties a sef an fcm a ccp and another fcm.

Thus an exchange rate has two components the domestic currency and a foreign currency and can. In the bilateral world all aspects of an agreed trade legal credit market and operational risks are dealt with directly between the two transacting parties. Nominal effective exchange rate neer is the unadjusted weighted average value of a currency relative to other major currencies traded within an index.

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

:max_bytes(150000):strip_icc()/shutterstock_336563996.currency.cropped-5bfc31f146e0fb00517d194b.jpg)

/the-abstract-image-of-the-business-man-hold-the-virtual-hologram-on-hand--the-concept-of-currency--financial--online--businessman--information-technology-and-internet-of-things--986668026-f0ab7a76cca3438ea152fa10a93cec40.jpg)