Bilateral Vs Multilateral Exchange Rate

Company a agreed to pay a 3 fixed rate on.

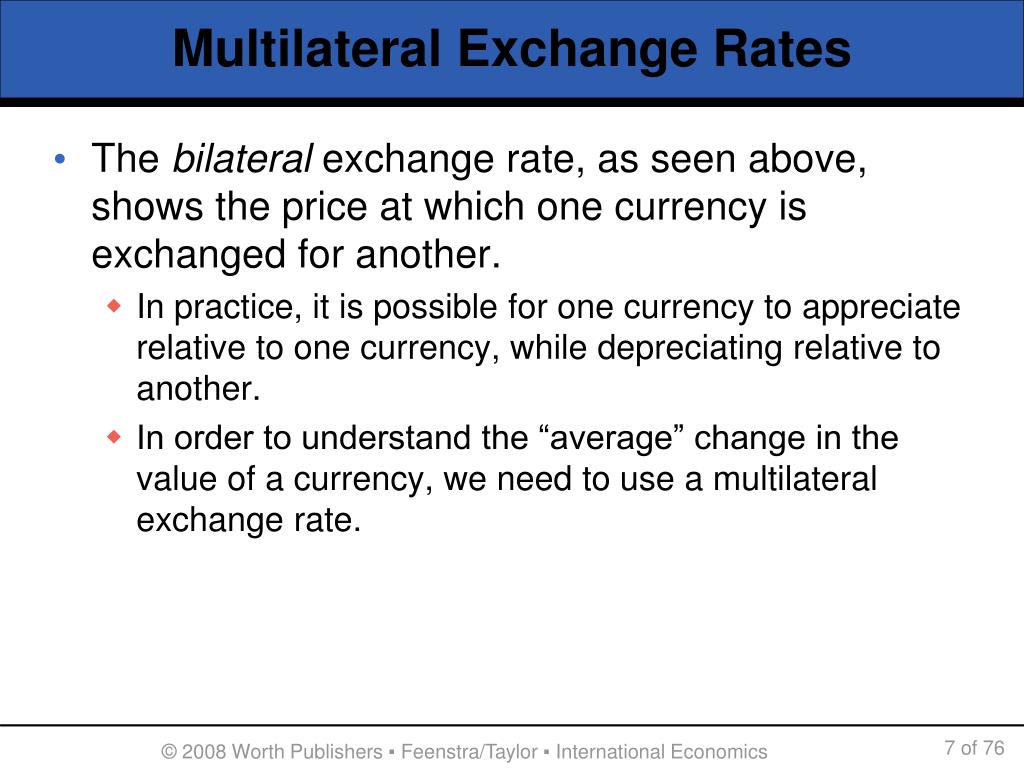

Bilateral vs multilateral exchange rate. A multilateral exchange would involve a third party for example. What are multilateral trade agreements. Whereas in the 1990 s and as late as 2002 the competition authorities gave the international card schemes clearance when they filed their interchange fee arrangements albeit the latter one with conditions now the regulators seem to be very much of the opinion that the multilateral interchange fees mif rate setting arrangements of the card. Of the sample period or the choice of bilateral multilateral exchange rates.

Multilateral netting involves more than two parties likely using a clearing house or central exchange whereas bilateral netting is between. A multilateral exchange is a transaction or forum for transactions which involve more than two parties. Thus it is an economic agreement between three or more countries at the same time as with bilateral trade agreements the purpose of a multilateral trade agreement is to promote enhance and regulate trade between the contracting nations in an equal manner. Public transactions or consumption and investment imports one can see multiple exchange rates existing.

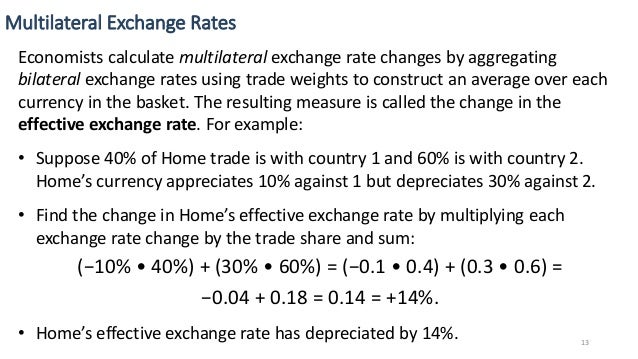

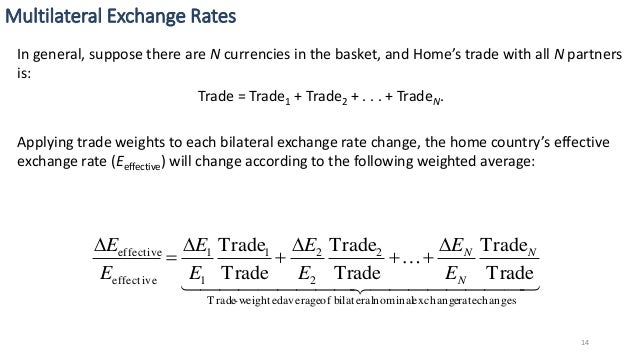

By design movements in the currencies of those trading partners with a greater share in an economy s exports and imports will have a greater effect on the effective exchange rate. Depending on the commercial vs. In a multilateral highly globalized world the effective exchange rate index is much more useful than a bilateral exchange rate such as that between the australian dollar and the united states dollar for assessing changes in the competitiveness due to exchange rate movements. For example alice gives bob an apple in exchange for an orange that is a bilateral exchange.

Alice gives an apple to bob who gives an orange to charles who gives a pear to alice. The multilateral real exchange rate index itcrm measures the relative price of the goods and services of the argentine economy with respect to those of the main 12 commercial partners of the country weighted by the trade flow of manufactures. So the bilateral vs effective exchange rate title of this section is not so much a competition between the two but more often that not for most countries a combination of the two. Several institutions such as international monetary.

Previous studies have been limited to quarterly data resulting in a small number of samples. Effective exchange rate exr. Multilateral real exchange rate index itcrm and bilateral. This study gathered a larger number of samples from monthly data and employed multilateral exchange rates to explore the feasibility of various exchange rate models.

Multilateral rate that measures the overall nominal value of a currency in the foreign exchange market.